【Transcription】Earnings Results for the Fiscal Year Ended June 2025

-

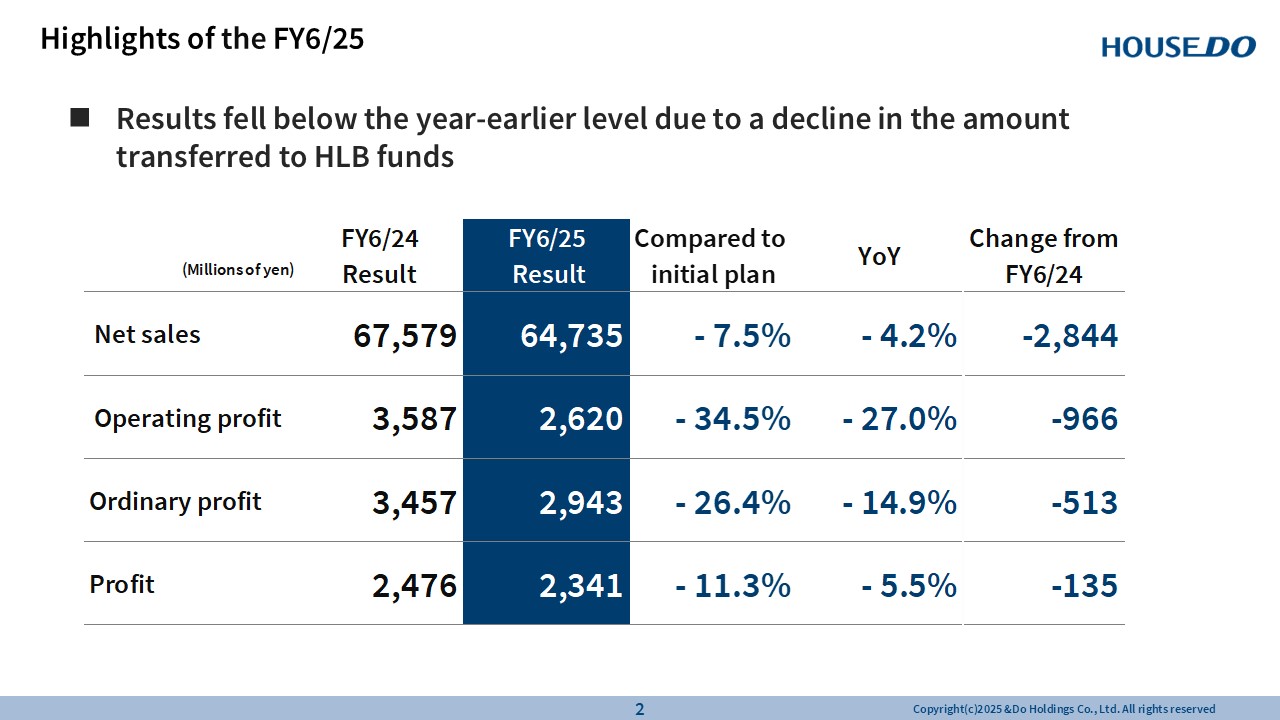

Highlights of the FY6/25

I would now like to present the financial results for &Do Holdings for the fiscal year ended June 30, 2025.

To begin, here is the financial summary for the fiscal year ended June 30, 2025, covering net sales through profit.

Four items are presented here.

Starting with the key takeaway, both sales and profit declined. As shown, results fell below the year-earlier level due to a decline in the amount transferred to HLB funds.

Let me offer a brief supplementary explanation.

These funds contributed 17,700 million yen to net sales in the fiscal year before last.

In the previous fiscal year, these operations were affected by various circumstances?specifically, reputational concerns surrounding leaseback operations.

In addition, on the profitability side, there was an increase in fund senior loans and other related costs. After including other expenses, the total for the previous fiscal year was 8,200 million yen. In terms of fund transfers, there was an effective decline of 9,500 million yen compared to the fiscal year before last and the previous fiscal year.

However, as already mentioned, the Real Estate Buying and Selling Business enjoyed significant growth. This helped drive a recovery in net sales, resulting in a decrease of 2,844 million yen year-on-year.

Moving on to operating profit. In particular, operating profit and ordinary profit decreased in tandem with the decline in net sales.

Profit came to 2,341 million yen, supported by an extraordinary gain from the sale of the rental management business announced on February 6, which limited the year-on-year decline to single digits. In conjunction with this, we raised our dividend from 43 yen to 45 yen.

-

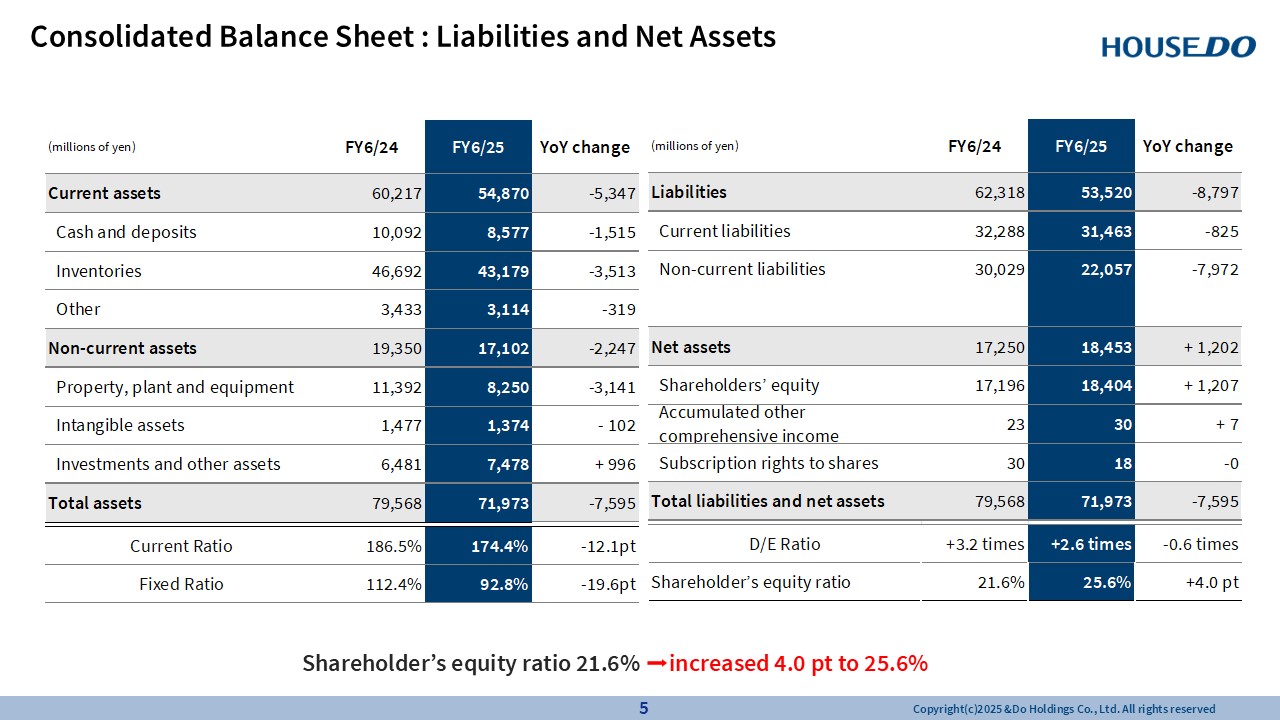

Consolidated Balance Sheet : Liabilities and Net Assets

Let’s now move on to the consolidated balance sheet. In this section, I would like to provide an explanation of fund movements.

The most significant item is liabilities. As you can see, there was a decrease of 8,797 million yen.

I will touch on this again later in the cash flow section, while both current and non-current liabilities, short-term and long-term, all contributed to the decline.

This decrease was particularly significant and contributed to the overall result.

Looking at current and non-current assets in this context, the sale of non-current assets resulted in a decrease of 3,140 million yen. With regard to inventories, although net sales in the Real Estate Buying and Selling Business increased, we placed strong emphasis on inventory turnover. As a result, despite the increase in net sales, inventories also decreased by 3,513 million yen. Compared to the previous fiscal year, this resulted in a total reduction of 7,595 million yen.

The D/E ratio was -2.6x.

We are generally aiming for a shareholders’ equity ratio of around 30%, and this was particularly supported by increased profit and net assets, along with a reduction in liabilities.

We significantly reduced our total assets. However, as you can see, in the Real Estate Buying and Selling Business, we did not seek to maintain stability through contraction but naturally aimed for higher net sales. As a result, the shareholders’ equity ratio rose significantly by 4.0 pt, reaching 25.6%.

-

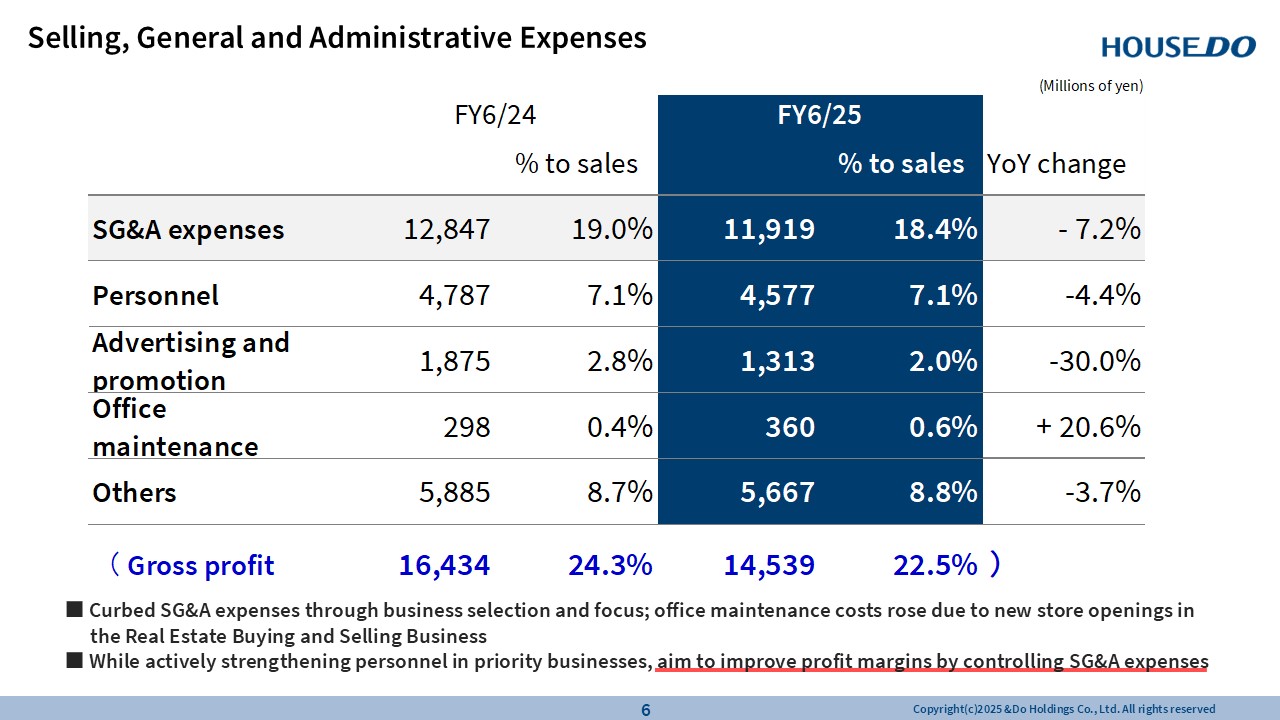

Selling, General and Administrative Expenses

Meanwhile, in terms of the breakdown of SG&A expenses, we have been reviewing these items for some time.

In particular, advertising and promotion expenses decreased 30%. This was largely due to significant cuts in advertising for the House-Leaseback Business, which contributed to the overall reduction.

Expenses in each category declined roughly in line with targets. We intend to continue pursuing further reductions in SG&A expenses going forward. -

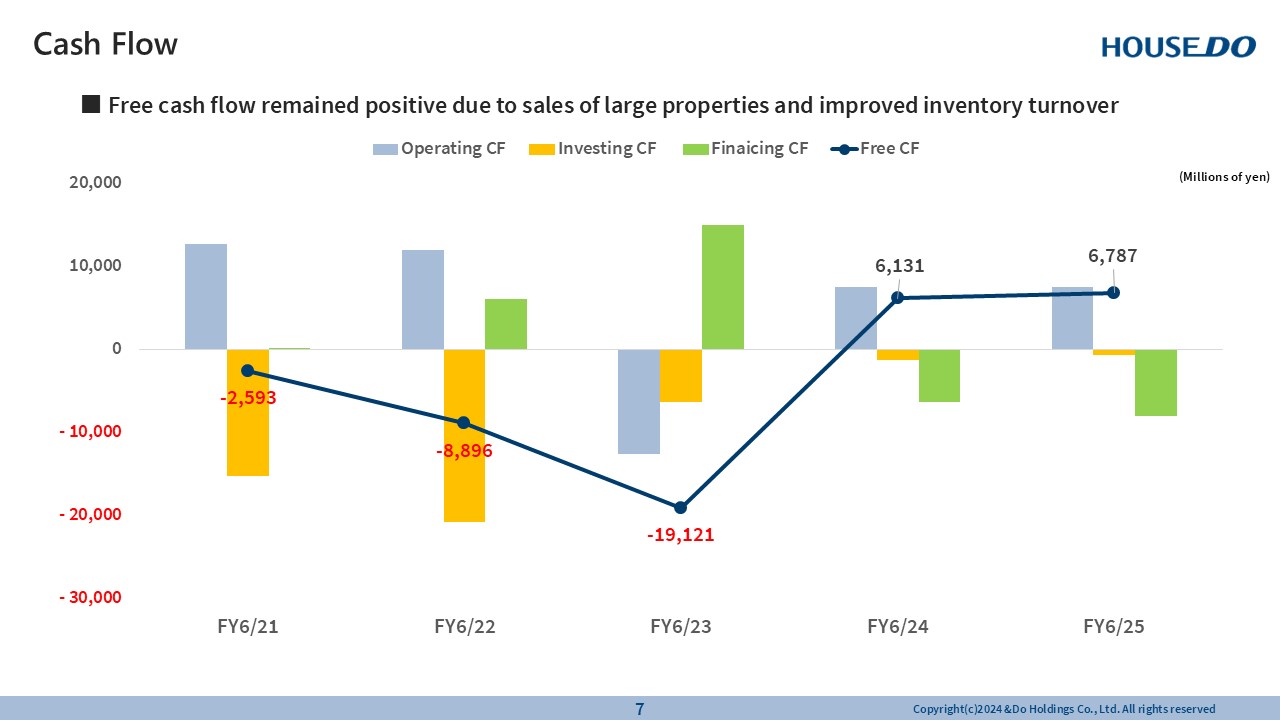

Cash Flow

Turning to cash flow, as we have noted in earlier briefings, we have taken on significant challenges under our current medium-term management plan. In order to secure properties, we of course increased borrowings significantly and worked to raise net sales. As a result, from 2021 to 2023, cash outflows from investing activities were considerable, leading to substantial negative free cash flow.

However, since 2024, we have been working to improve our financial position, and we believe that over the past two years or so, we have made significant progress in securing financial soundness.

-

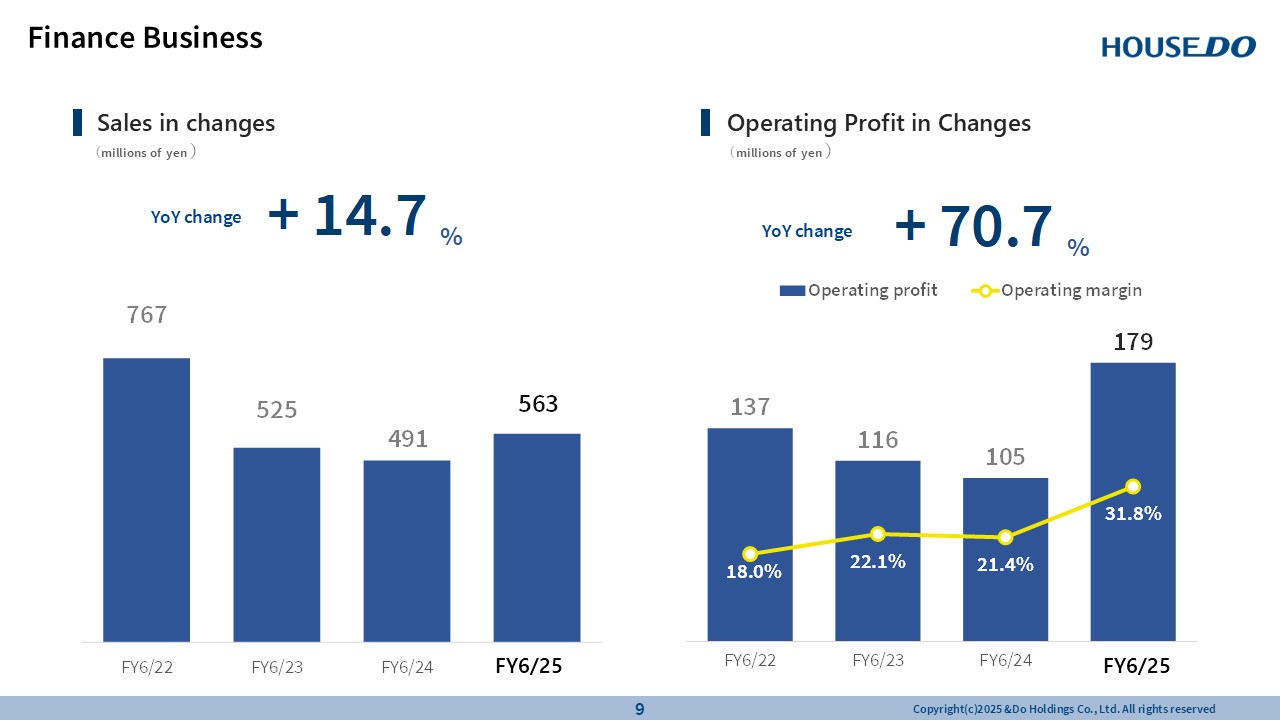

Finance Business

Next, I would like to provide an overview of the Finance Business, which is my responsibility.

Net sales have finally begun to recover, reaching 563 million yen, a 14.7% year-on-year increase. This growth was of course driven by the expansion of our reverse mortgage guarantees.

Alongside this, let me explain the trend in operating profit.

In the fiscal year ended June 30, 2020, the Finance Business still had a high proportion of consumer lending, with net sales of 767 million yen; however, operating profit was low. By the fiscal year ended June 30, 2025, the business has largely transitioned to the guarantee business, resulting in a significant increase in operating profit.

-

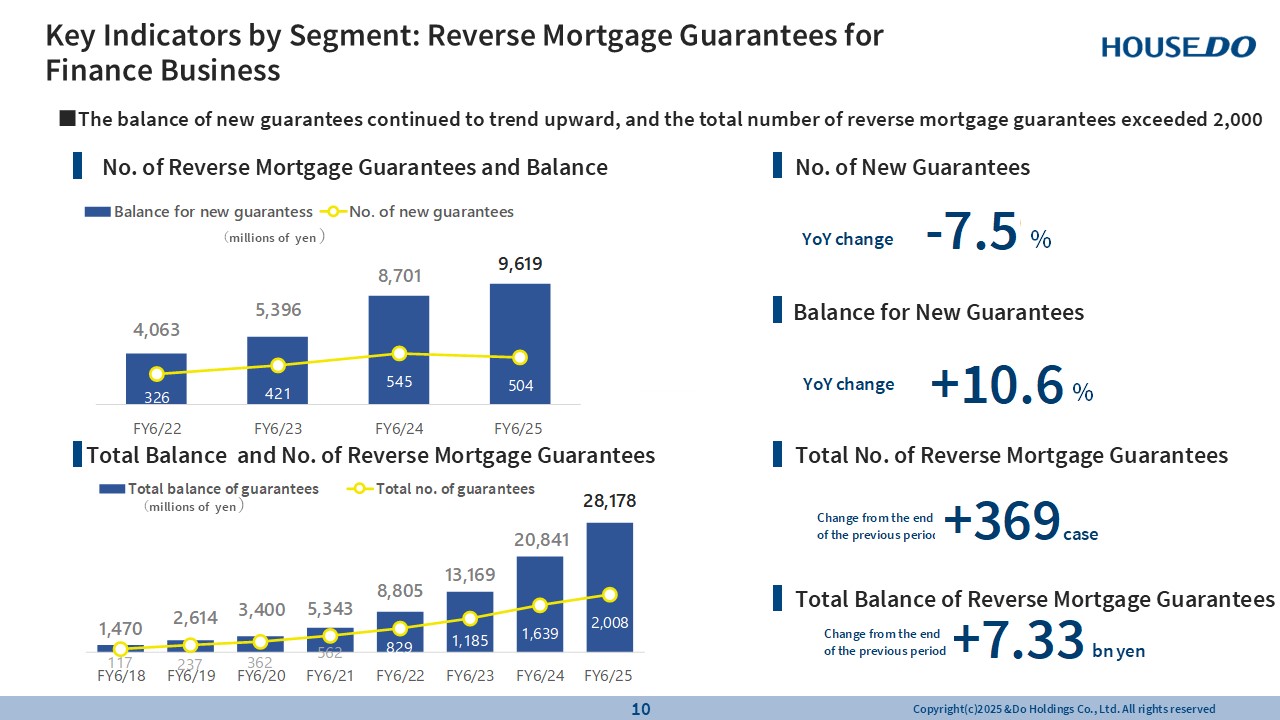

Key Indicators by Segment: Reverse Mortgage Guarantees for Finance Business

Next, under key segment indicators, we turn to reverse mortgage guarantees. We are pleased to report that both the balance and number of new guarantees have grown substantially.

For the fiscal year ended June 30, 2025, the total came to 28,178 million yen. The total number of reverse mortgage guarantees has exceeded 2,000, with a total balance of 28,000 million yen, approaching 30,000 million yen. As indicated on the right, this marks an increase of roughly 7,300 million yen.

As for the number of guarantees, while there was a slight decline at some individual financial institutions, the overall trend remained largely flat. At the same time, both the balance of new guarantees and the total balance of reverse mortgage guarantees have shown significant growth.

-

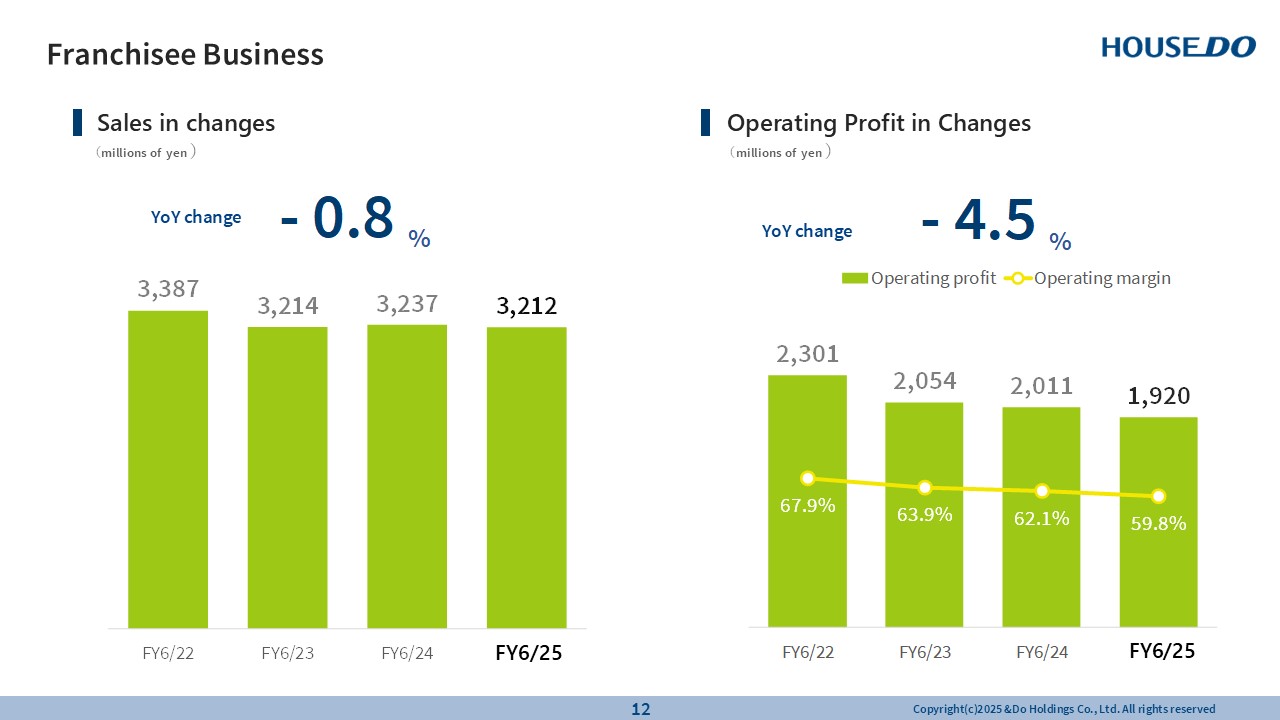

Franchisee Business

Now, I would like to provide an overview of each business segment.

First, in the Franchisee Business, net sales declined 0.8% year-on-year, while operating profit fell 4.5%.

-

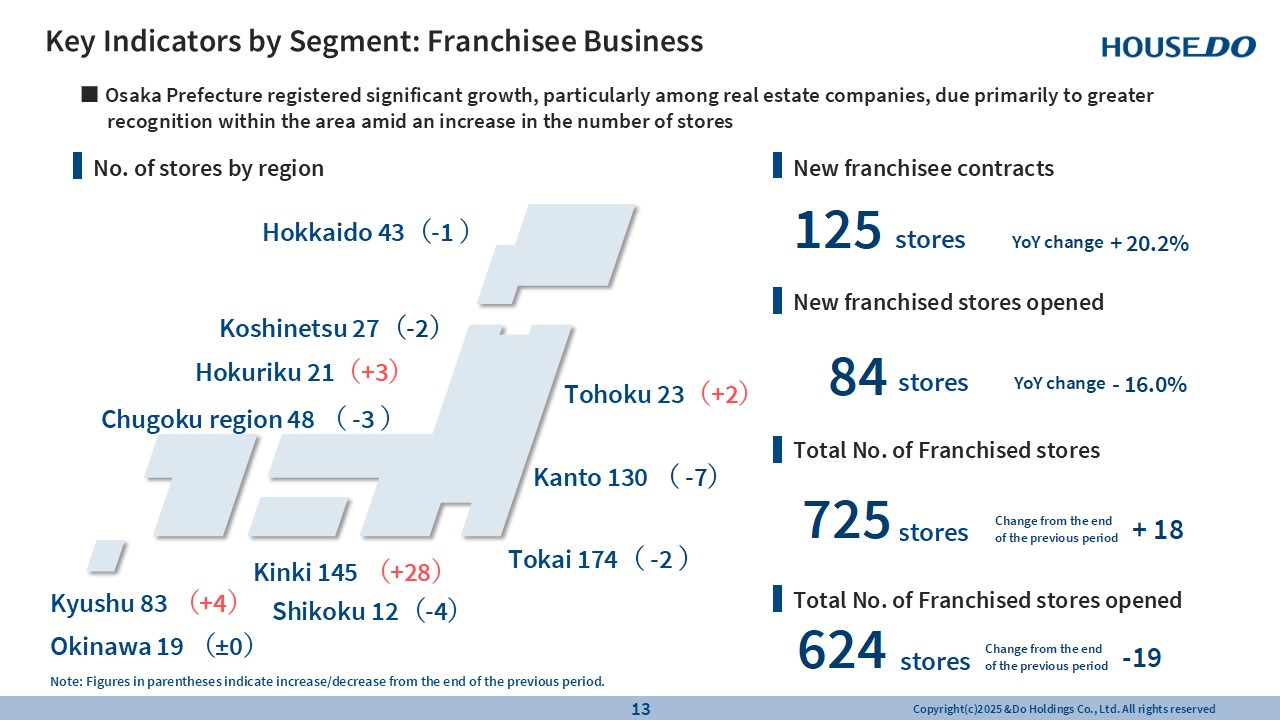

Key Indicators by Segment: Franchisee Business

In terms of changes in franchised store development, new franchisee contracts increased 20.2% year-on- year, which is the most notable aspect.

One key factor was an increase in sales personnel.

By region, the Kinki area stood out, with an increase of 28 stores, particularly centered around Osaka Prefecture, where franchisee contracts have been performing very well.

As for the earlier-mentioned decline in operating profit, the main factor was the reinforcement of personnel.

-

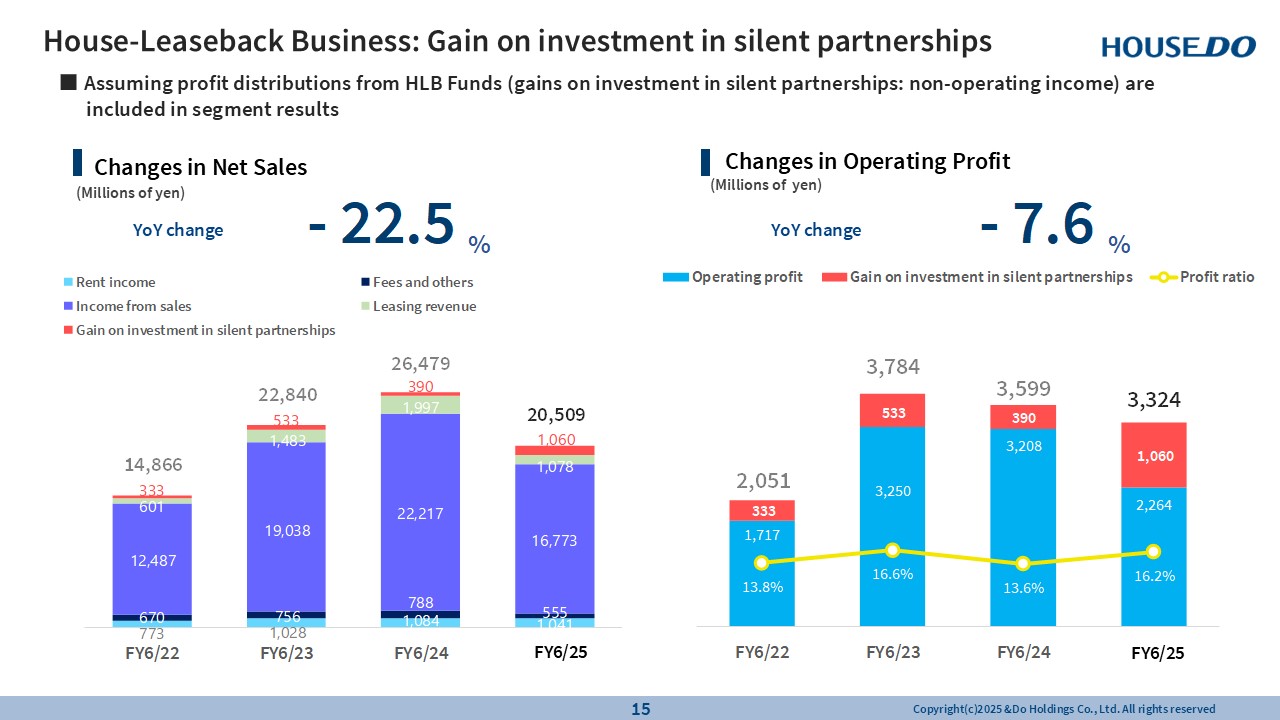

House-Leaseback Business: Gain on investment in silent partnerships

Next, let’s take a look at the House-Leaseback Business. The figures here reflect gains on investments in silent partnerships.

First, net sales declined 22.5% year-on-year, and operating profit fell 7.6%, resulting in negative growth in both areas.

-

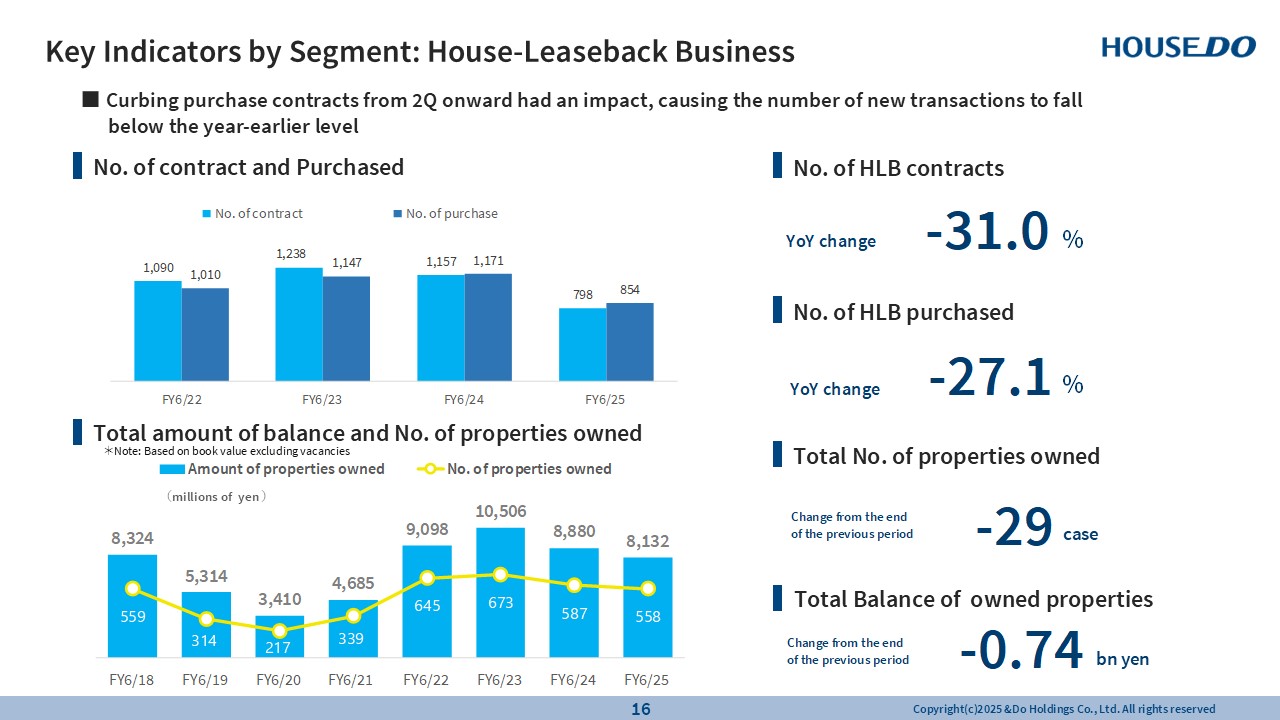

Key Indicators by Segment: House-Leaseback Business

This table shows the number of purchase contracts.

The number of contracts decreased 31.0% year-on-year, and the number of newly acquired properties also fell 27.1%. As explained previously, this reflected efforts to curb purchase contracts from the second quarter onward.

-

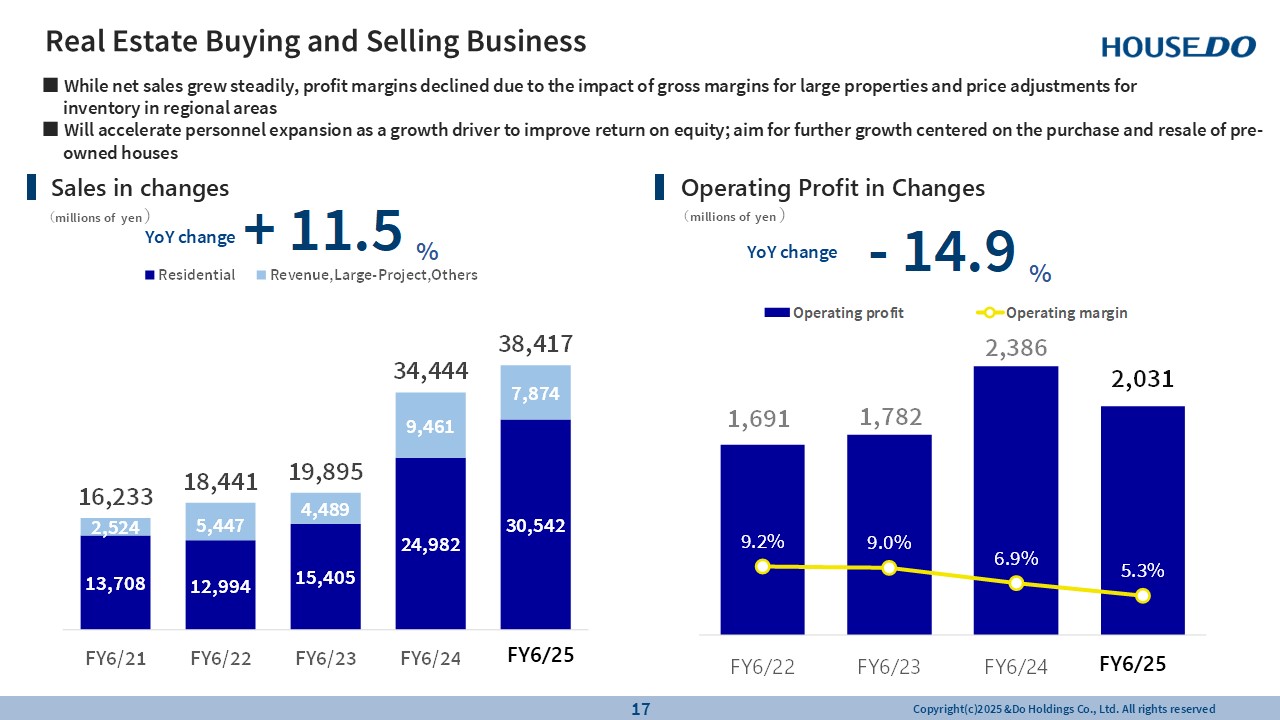

Real Estate Buying and Selling Business

Moving on to the Real Estate Buying and Selling Business.

Net sales increased 11.5% year-on-year, while operating profit fell 14.9%. This was due to the fact that, although net sales grew steadily, profit was affected by differences in gross margins on large properties compared with the previous year.

In addition, profit margins declined due to price adjustments for inventory in regional areas. We consider this the result of our focus on inventory turnover.

-

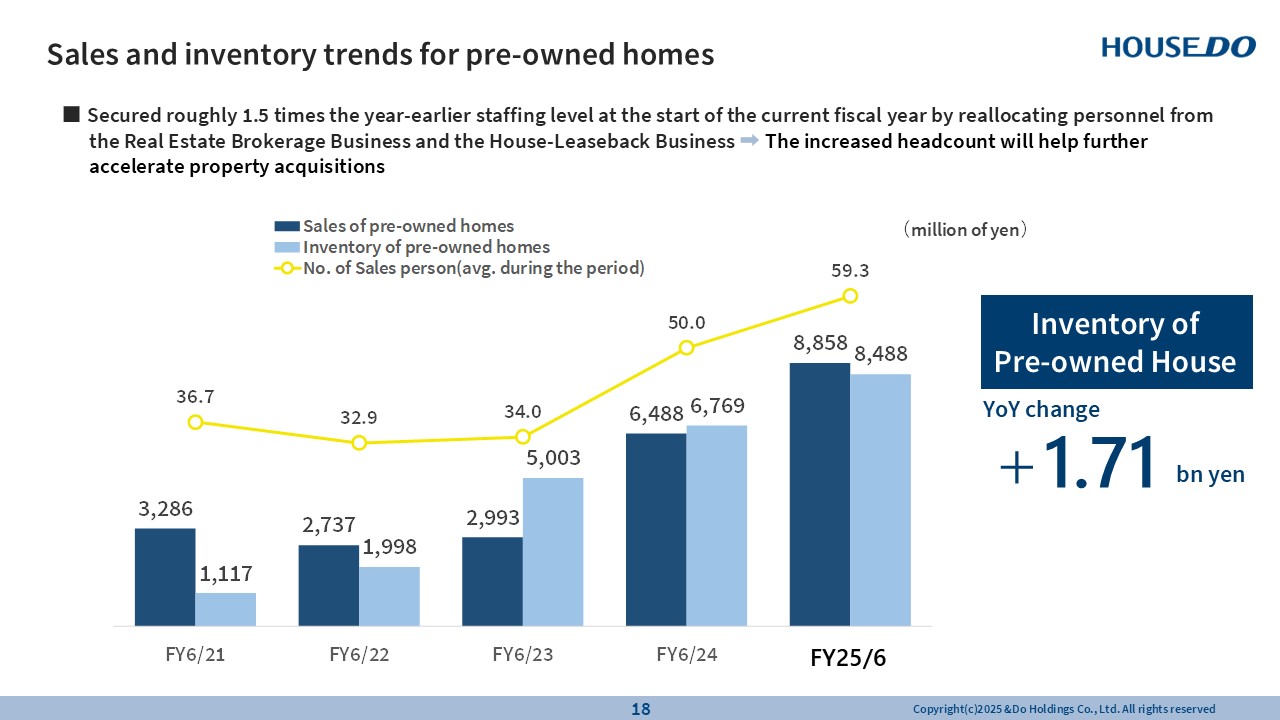

Sales and inventory trends for pre-owned homes

Notably, as a result of shifting personnel from the Real Estate Brokerage Business and the House-Leaseback Business, we had already secured about 1.5 times the number of personnel compared with the previous fiscal year at the start of the current fiscal year.

In practice, securing personnel ultimately leads to securing inventory, which will be converted into net sales going forward. We are currently in that phase.

-

5-years Business Plan

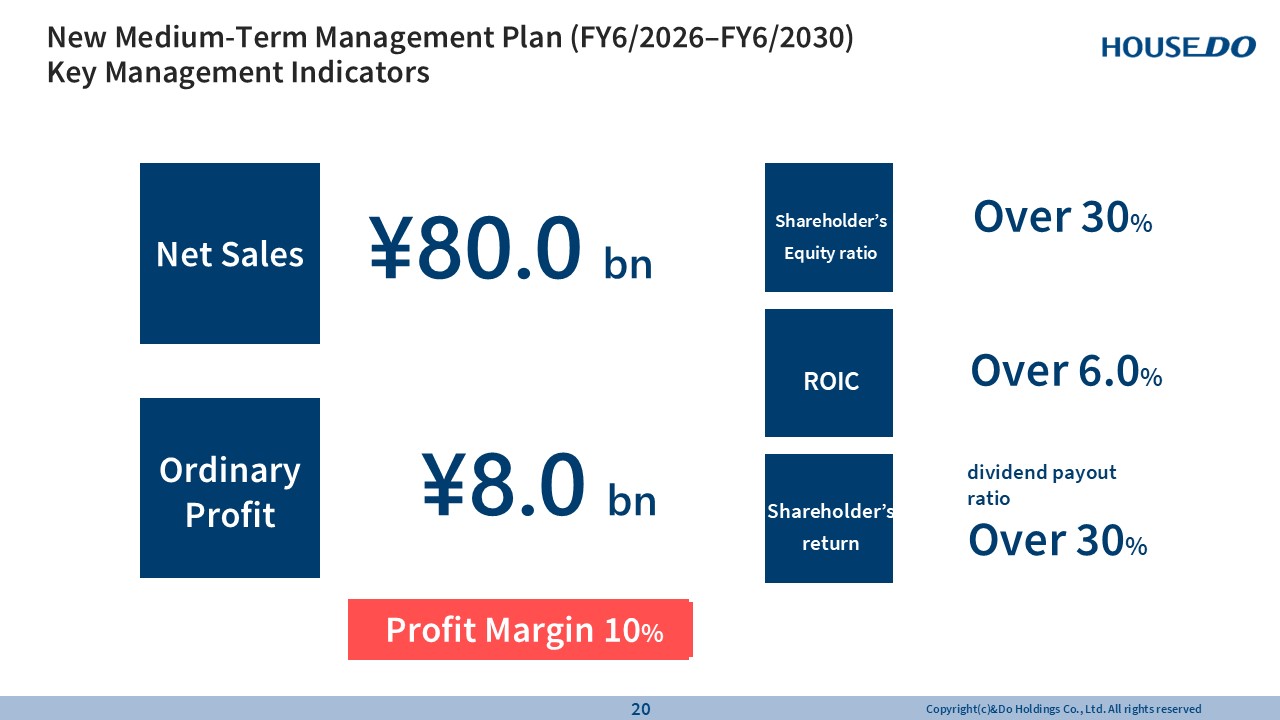

Next, I will provide a summary of the key points of our five-years business plan.

As previously announced, our goal over the next five years is to achieve 80,000 million yen in net sales, 8,000 million yen in ordinary profit, and an ordinary profit margin of 10%.

Until now, our company has operated with very low profit margins. This was the result of concentrating capital and profits into the launch of new businesses?specifically, the House-Leaseback Business and the reverse mortgage guarantee business. Going forward, we intend to scale down the House-Leaseback Business and narrow our segment focus.

We are also proceeding with the sale of the rental management business and the Renovation Business.

We intend to pursue a strategy of downsizing low-margin divisions and strengthening high-margin businesses.

-

Growth-Driving Businesses

Now, turning to these three businesses. The Franchisee Business has seen a slight slowdown in growth, but we have identified the key areas to address and will strengthen those to drive further expansion. As this is a business with extremely high margins and strong potential, we intend to grow it steadily.

Next is the Real Estate Buying and Selling Business. Here, we will place particular emphasis on strengthening our pre-owned housing operations. I will explain this later.

Lastly, reverse mortgage guarantees. We intend to grow these operations along with the business guarantees that accompany it. We consider these three businesses to be our growth-driving businesses.

-

Reasons for the decline in House-Leaseback

As for the reason behind the downsizing of the House-Leaseback Business, we believe we have addressed this on several occasions: it stems from negative media coverage surrounding leaseback services. In the first half of this year, various media outlets reported on highly problematic practices by certain operators, which led to a decline in inquiries. While we believe inquiries have since recovered, we continue to feel that handling customer relationships in this area has become extremely difficult.

Next, let's move on to funds. We have been selling House-Leaseback properties to funds, but in light of rising interest rates and the resulting cautious stance, along with negative media coverage, we made a comprehensive assessment and ultimately decided to scale down this business.

At the same time, the reverse mortgage guarantee business has been growing strongly, so we are shifting our focus there. This was, in fact, the original intent. House-Leaseback customers, at heart, do not want to sell their homes. They are really seeking financing. That is why we launched reverse mortgage guarantees.

Therefore, as this business is gaining momentum at just the right time, we will shift our focus toward it. This is the reason for scaling down the House-Leaseback Business.

However, we are not exiting the House-Leaseback Business; we will continue to engage in it as needed.

-

Strategic Use of House-Leaseback

There are also cases where customers shift from a reverse mortgage to a House-Laseback arrangement, and such cases are gradually increasing, though the volume is not large.

In addition, banks are beginning to use House-Leaseback as one method of handling debt resolution.

House-Leaseback have proven to be a very effective means in such contexts, and we hope to contribute to debt resolution efforts through this approach.

We intend to position the House-Leaseback Business as a solution for strategic applications going forward.

-

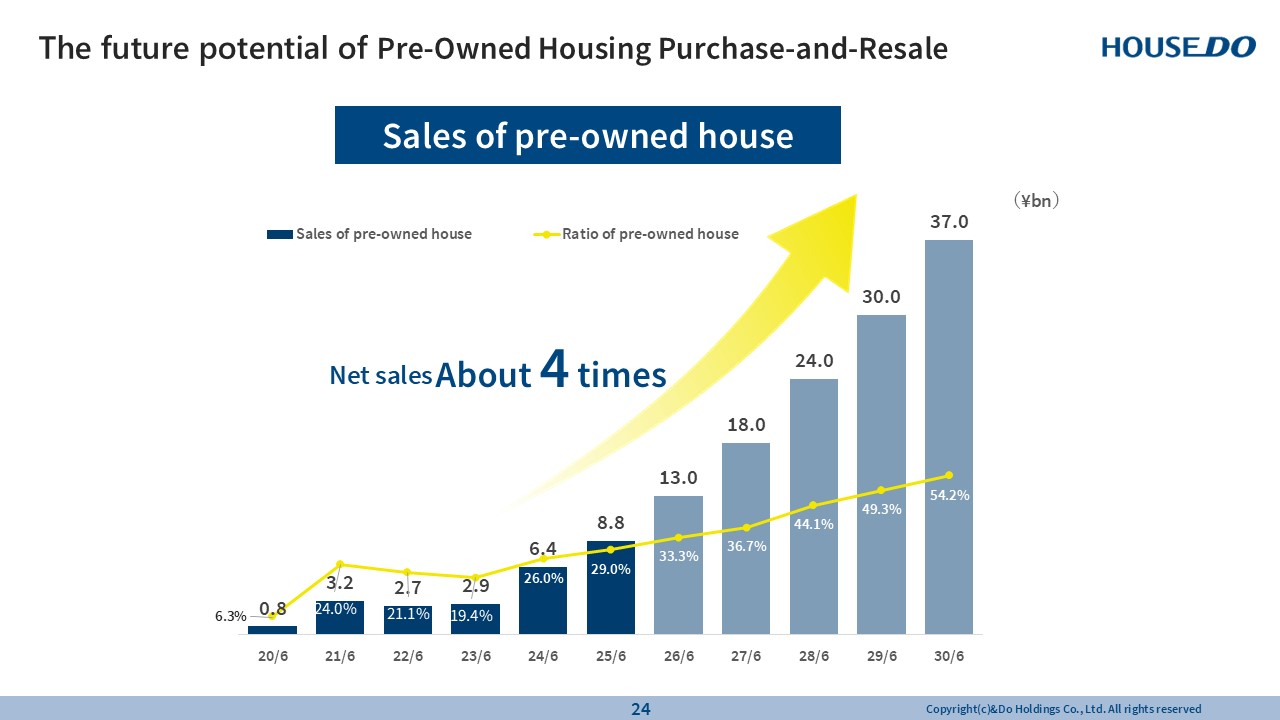

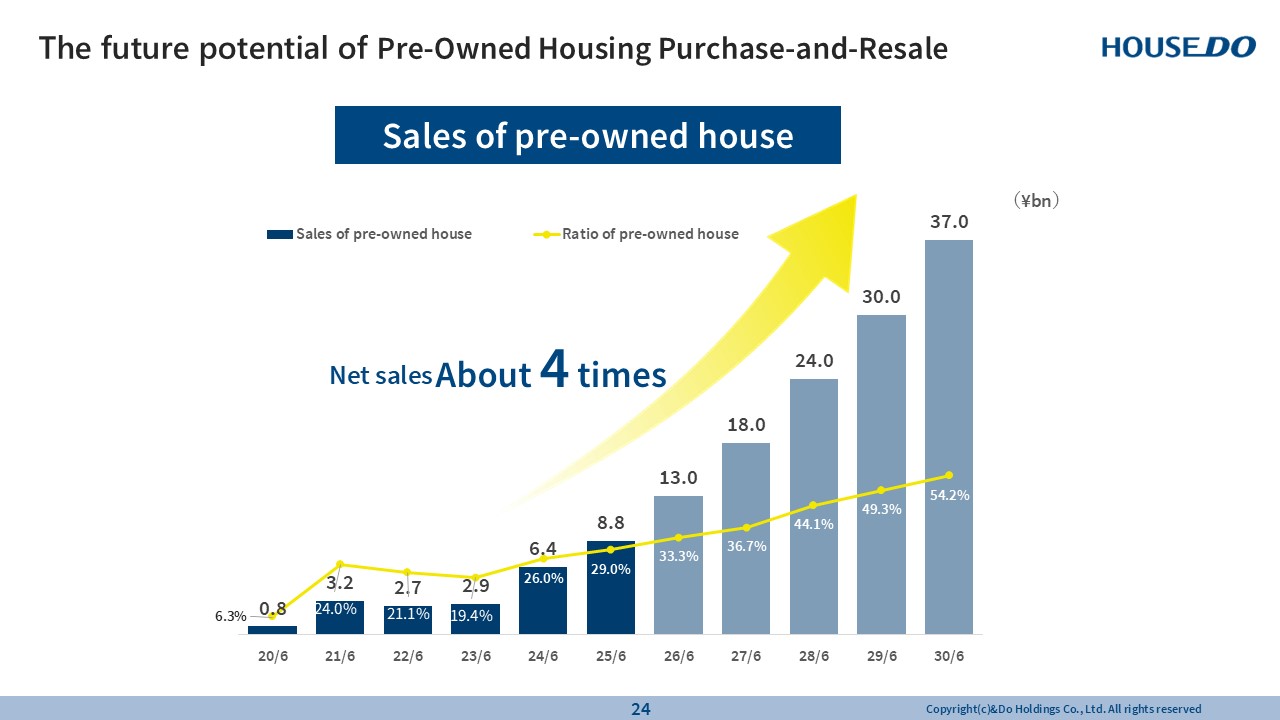

The future potential of Pre-Owned Housing Purchase-and-Resale

Going forward, we will strengthen and specialize in pre-owned housing operations.

Our target is to reach net sales of 37,000 million yen from pre-owned housing alone within five years. Within the Real Estate Buying and Selling Business, while we will do some work in newly built for-sale homes, the 37,000 million yen figure refers only to pre-owned housing.

We believe that the market is moving in this direction.

The era of pre-owned housing has finally arrived in Japan as well.

When a pre-owned house is being sold by someone currently living in it, it is, as expected, in need of some care and somewhat worn. The idea is that a new customer buys the property and renovates it themselves. However, in such cases, the buyers are still living in their current home while purchasing a new one and carrying out renovations?which puts them in a financially tight position. Should they purchase the property using bridge financing? Or should they take out two housing loans at once? For such customers, we?as a business operator?step in to purchase the property, renovate it, and then sell it.

When the customer is able to purchase a property in a state ready for immediate occupancy, it is a very rational choice. The brokerage process is incredibly smooth. This is where the purchase and resale of pre-owned houses is highly effective.

-

The future potential of Pre-Owned Housing

Now, with regard to the future potential of pre-owned housing, I believe that we are undoubtedly heading into an inflationary environment.

Along with that comes rising costs. In the deflationary period to date, during which everything was highly affordable, building materials were very inexpensive too, and as a result, newly built houses were supplied at very low prices. With both interest rates and material costs at low levels, it was only natural for people to buy newly built houses. However, we are now beginning to see a reversal of that trend. Construction material prices are rising, interest rates are also going up, and newly built houses are becoming harder to sell. In such an environment, we believe demand will increasingly shift toward high-quality pre-owned houses.

And then there is the issue of the declining birthrate and aging population. With these demographic changes, the population as a whole will keep shrinking. Areas within 10 to 15 minutes of train stations are unlikely to see population decline and may even experience growth. By contrast, areas 30 minutes away or where a car is essential are likely to face depopulation.

In such areas, when developers put 30 or 50 built-for-sale homes on the market, some of them inevitably remain unsold. This is already beginning to happen.

In our view, that means demand will move to individual pre-owned houses in good locations.

Therefore, this is the area we intend to target. With interest rates now beginning to rise as well, we believe this will be the direction of the market.

-

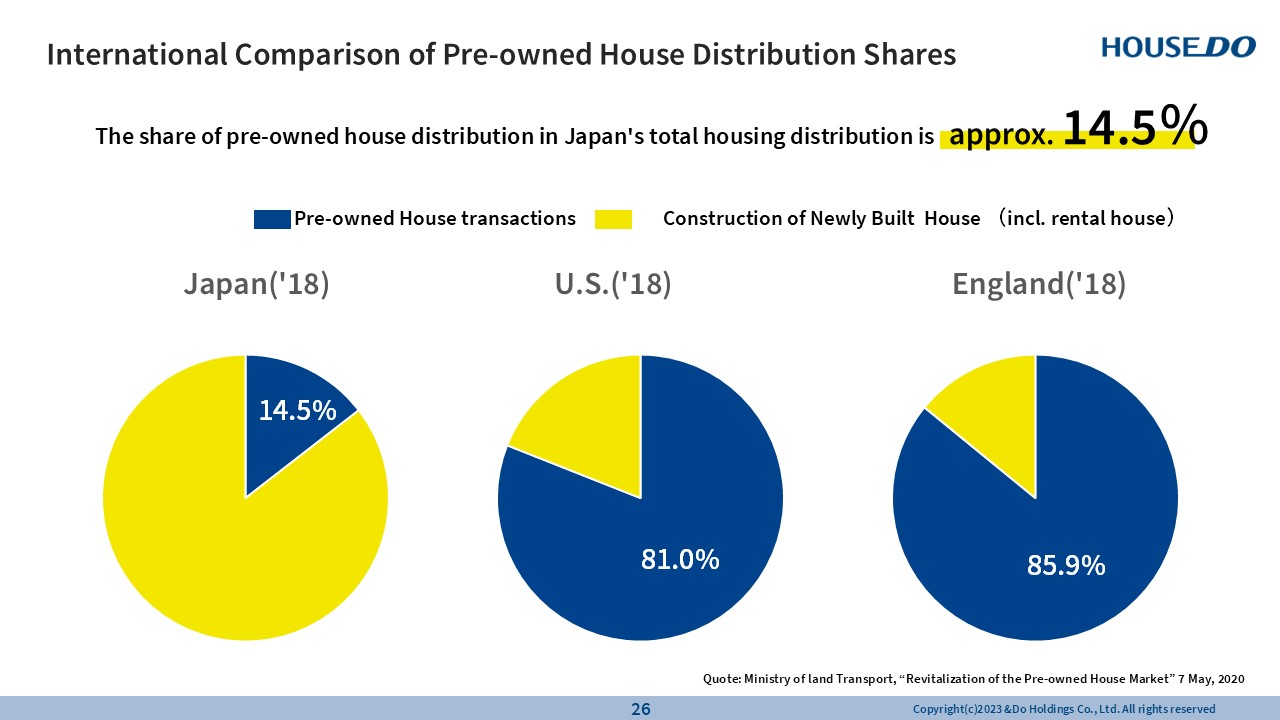

International Comparison of Pre-owned House Distribution Shares

Here is some international data. In terms of pre-owned housing brokerage, Japan stands at 14.5%, compared to 81% in the U.S. and 85.9% in the U.K. Japan has overwhelmingly favored newly built houses, which is unusual. While this was long considered the norm, I myself had always wondered about it.

Deflation was certainly one factor. Newly built houses were very inexpensive.

And if pre-owned houses and newly built houses are at about the same price, people will naturally choose the latter.

But now the trend is beginning to reverse. Newly built houses are becoming very expensive and increasingly difficult to buy. As a result, demand will shift to pre-owned houses, and Japan will end up becoming more like the U.S. and U.K. in this respect.

Based on this outlook, our strategy is to target this segment. We aim to become Japan’s number one pre-owned housing purchase-and-resale company.

-

Five-Year Plan for Reverse Mortgage Guarantee Business

Next is the guarantee business, specifically reverse mortgage guarantees. Our target is to reach 125,000 million yen in total guarantees five years from now. -

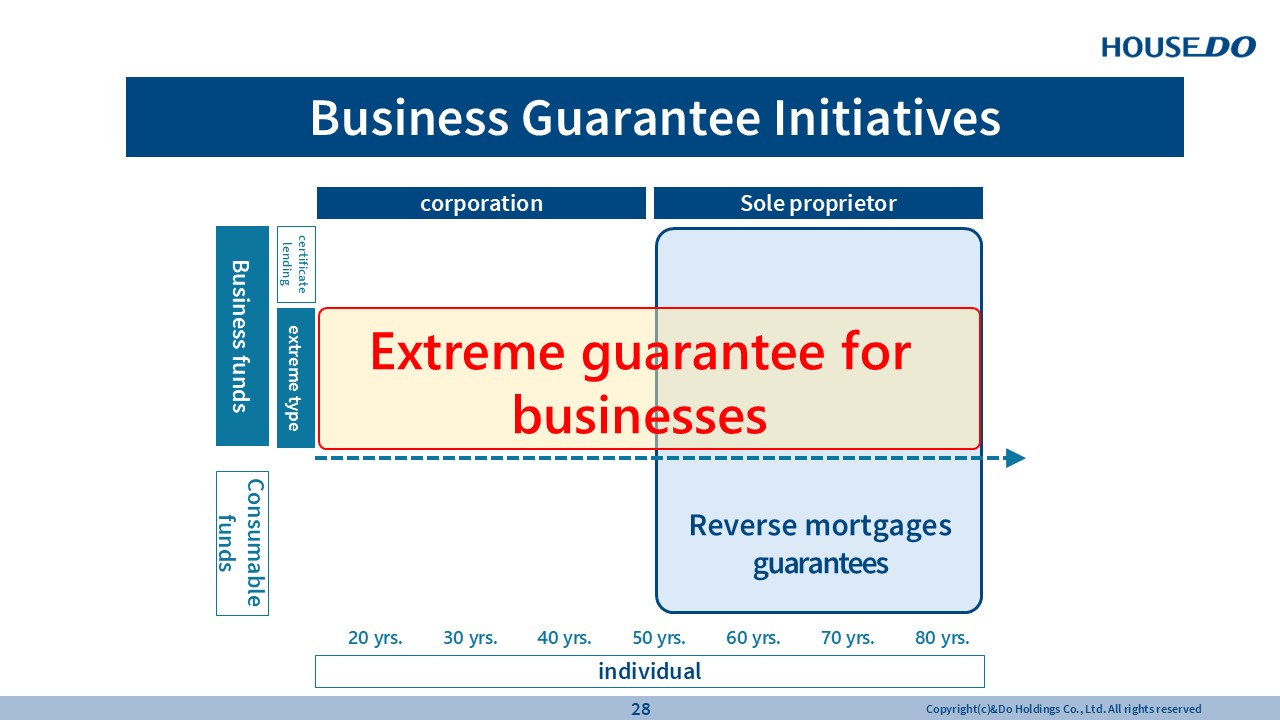

Business Guarantee Initiatives

Let’s now talk about our reverse mortgage plus business guarantee product.

This is an extreme guarantee for businesses, which we are introducing as a new offering.

We believe this area is likely to grow going forward.

An extreme guarantee means having a credit limit and being able to draw down or repay freely within that limit.

Personally, I would like to see this made available online?for example, withdrawing 2 million yen today and repaying it a week later?freely within the credit limit.

I want to be able to do this via the Internet. To date, each transaction has required bank approval and a formal internal review process.

We want to eliminate those steps and make it possible for customers to freely withdraw and repay funds. We are already in an era where everything can be done easily via smartphone.

This is the kind of world we want to help create?working behind the scenes in the capacity of a guarantor. Our role is to provide coverage through guarantees so that the valuable deposits of banks are not put at risk.

Since guarantees are backed by various guarantee fees, they function much like insurance.

In that way, we believe this business will become a powerful support for the Japanese economy.

-

The future potential of Reverse Mortgage and Business Loan Guarantees

Looking ahead, we expect inflation to take hold. As we believe the times are changing, we see Japan moving away from unprecedented monetary easing.

And as deflation shifts to inflation, we believe it is only natural that changes will occur within the financial system.

While conditions may become more challenging in some respects, we also believe that ample financial resources will flow into the economy a bit more. We would like to play one of the supporting roles behind the scenes in that process.

Next is the issue of shrinking pension benefits. With the declining birthrate, the number of contributors will decrease, so pensions will inevitably shrink. As a result, the amount individuals receive will also decrease.

In such a scenario, individuals who hold quality assets?such as real estate?can make use of them to have a more comfortable life in retirement.

This final shift in values is already happening.

We believe this transformation will continue and think we can make a contribution in this area.

-

Aiming for strategic growth

Finally, while we are engaged in various initiatives, what we ultimately aim for is stable property acquisition.

We want to increase our acquisition channels.

One such channel is acquisition through reverse mortgage guarantees.

At heart, that is our true intention. Rather than forcing people to sell their homes unwillingly, we want to establish a framework in advance to enable their use and facilitate smooth circulation of properties.

This applies to House-Leaseback as well as to direct acquisitions.

We intend to achieve strategic growth by pursuing a SPA strategy?one-stop solution from purchasing to sales?and expanding this business model into Asia.

The fundamental reason is that we want to secure stable property acquisition while avoiding competition as much as possible.

Competition drives up purchase prices.

And when purchase prices rise, risk inevitably increases.

That is why we are formulating this strategy?to increase non-competitive acquisitions.

The approach also aims to enhance customer satisfaction.

Through stable property acquisition, we will achieve stable growth. This is the guiding principle behind our business development, and so we ask for your understanding and support. That concludes my presentation. Thank you very much for your attention.