【Transcription】Earnings Results for the Second Quarter of Fiscal Year Ending June 2024

-

【Transcription】Earnings Results for the Second Quarter of Fiscal Year Ending June 2024

Thank you for joining our financial results briefing.

Sales and profit have both reached record highs, with net sales up 39.1% year on year and ordinary profit up 13.1% year on year.

-

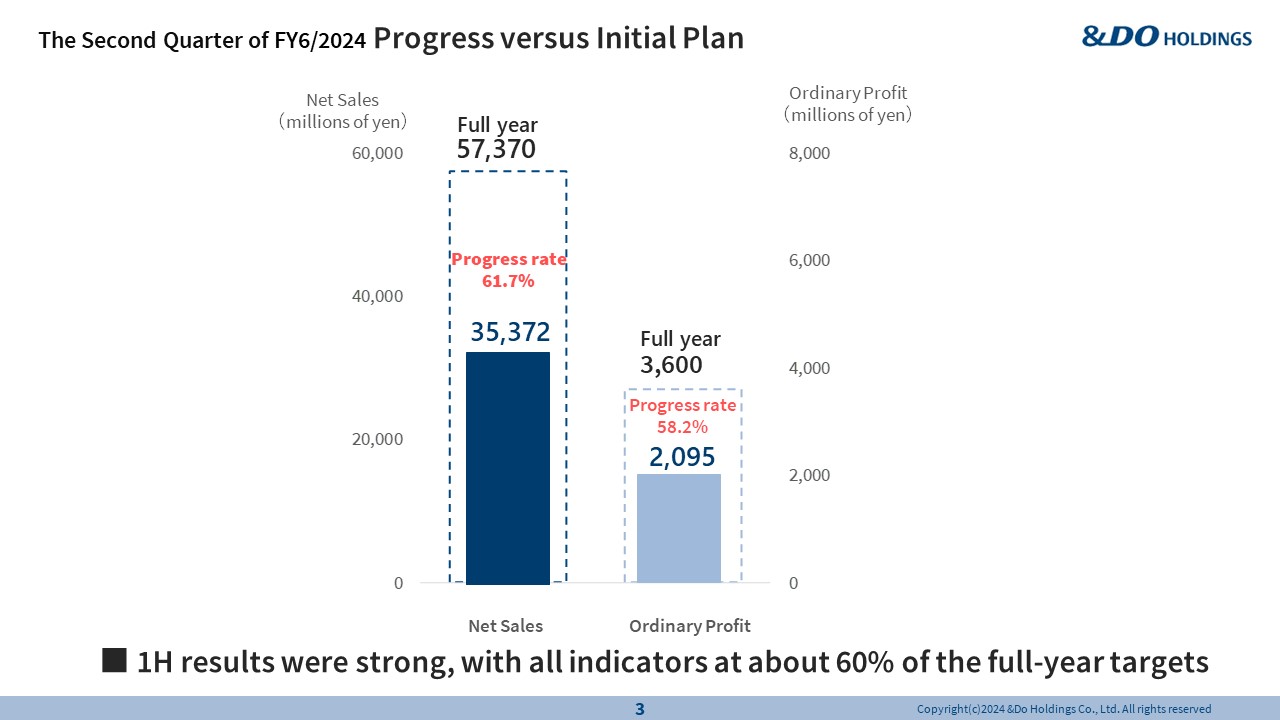

The Second Quarter of FY6/2024 Progress versus Initial Plan

As of the end of the second quarter, ordinary profit amounted to 2.1 billion yen, representing progress of about 60% versus the full-year ordinary profit target of 3.6 billion yen.

-

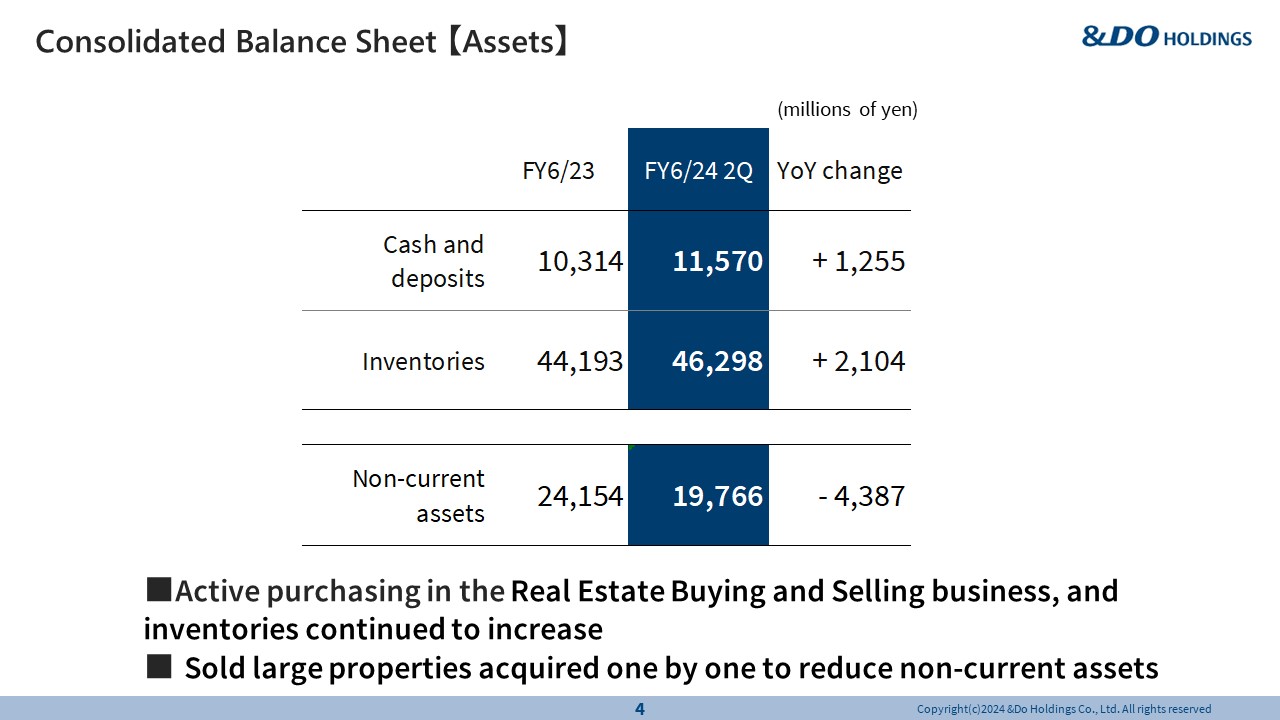

Consolidated Balance Sheet 【Assets】

Looking at assets, I would like to point out that cash increased slightly, and inventories were also up, reflecting the buildup of inventories in the Real Estate Buying and Selling Business. Because we need to accumulate inventories to drive growth in FY6/25 and FY6/26, we have been steadily procuring properties.

Non -current assets declined as we sold large properties. As announced in the results briefing for FY6/23, we have been steadily selling these properties to slightly bring down non-current assets during the three years under the current medium-term management plan, which ends in FY6/25. We plan to sell about 5 to 7 billion yen worth of large properties in FY6/24 and FY6/25, which will bring down this asset entry by a bit more. We intend to increase product inventories while curbing non-current assets to propel growth. -

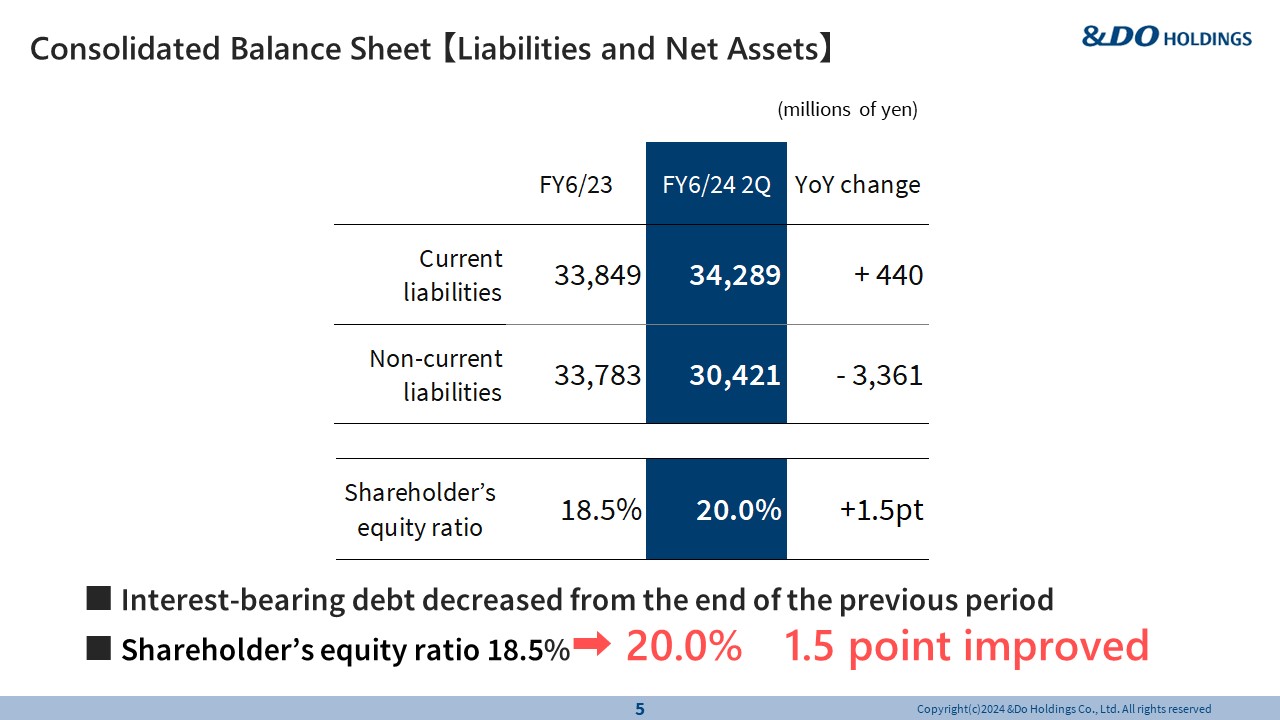

Consolidated Balance Sheet 【Liabilities and Net Assets】

The increase in current liabilities was due to borrowings to fund property procurement. Non-current liabilities include some long-term borrowings taken out to fund the purchase of large properties, and the decline here worked to boost the shareholders’ equity ratio, resulting in a healthy balance sheet. -

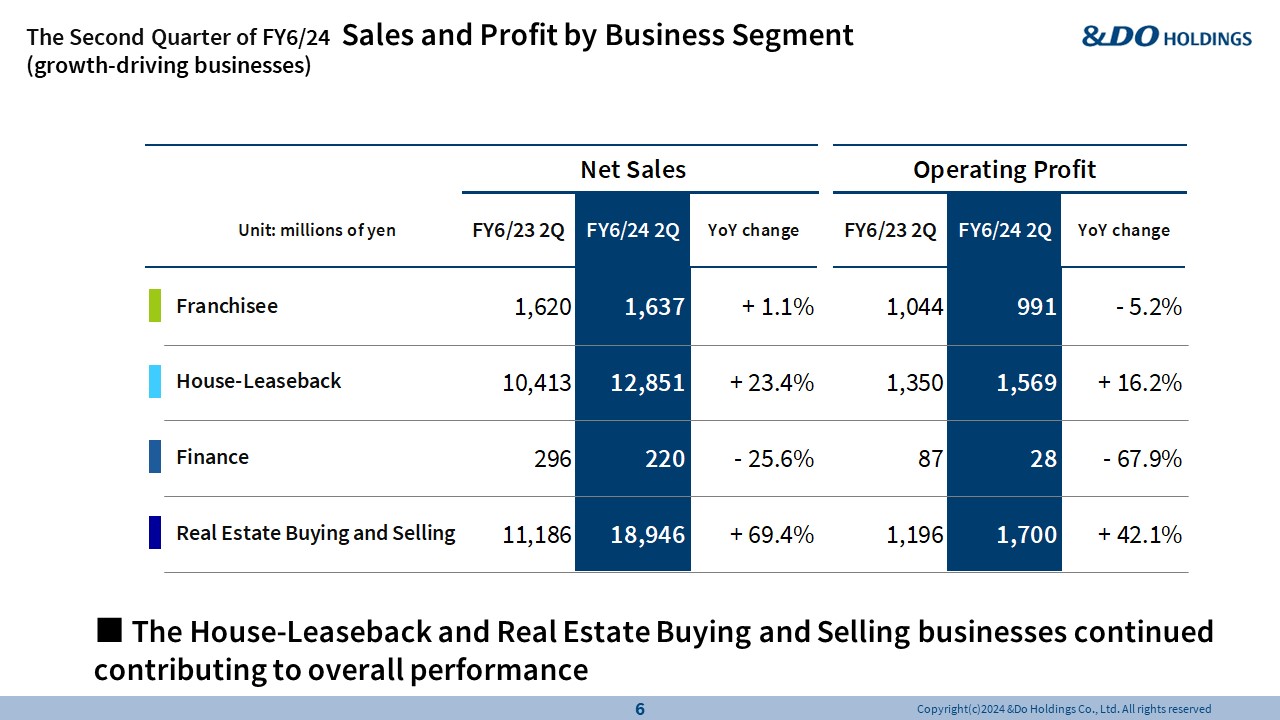

The Second Quarter of FY6/24 Sales and Profit by Business Segment (growth-driving businesses)

We intend to expand the four growth-driving businesses. The profit decline in the Franchisee Business was in reaction to the increase in contract cancellation fees collected from withdrawing franchisees in FY6/23, which has now settled down. We expect profit in the business to gradually grow going forward.

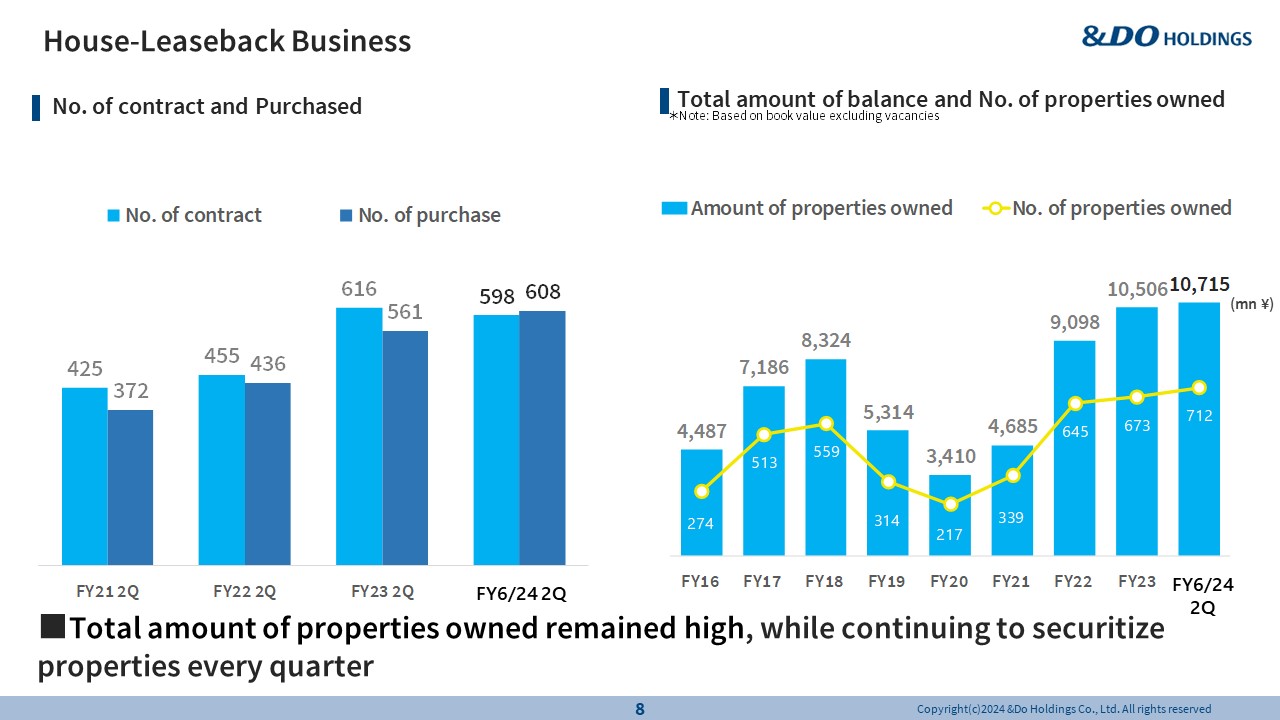

In the House-Leaseback Business, sales and profit were solid.

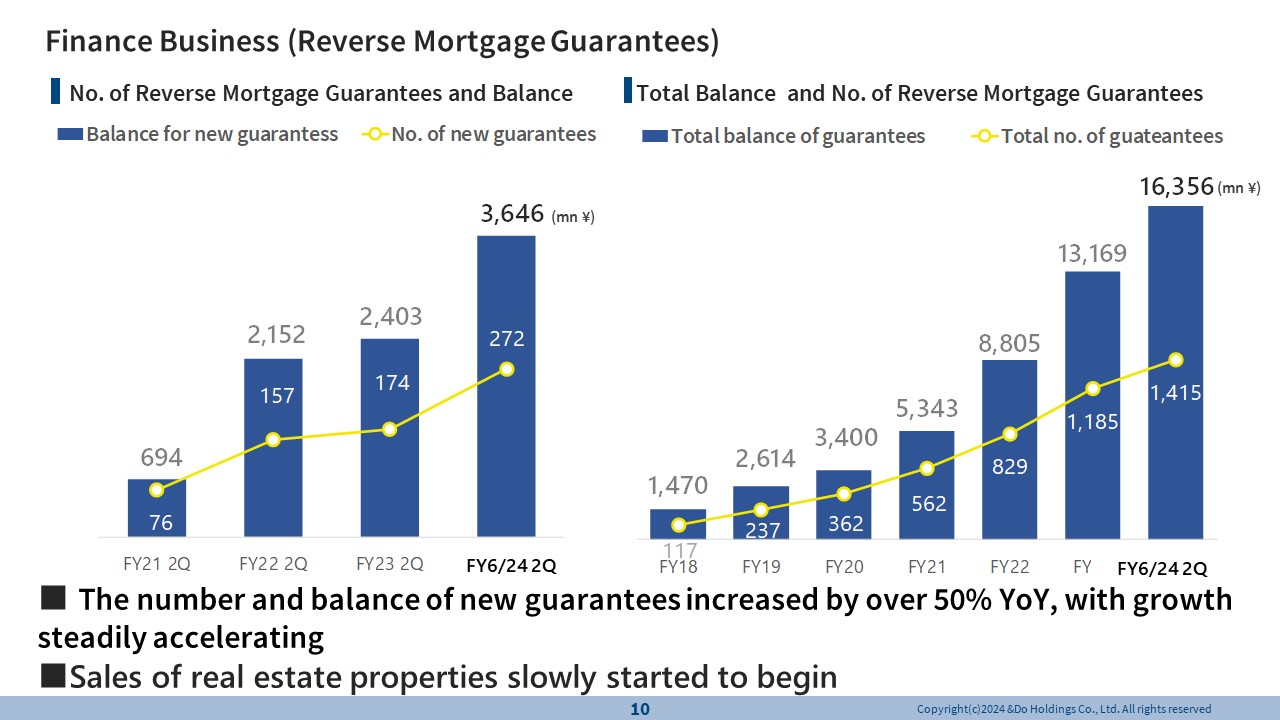

In the Finance Business, while numerical results declined as we scaled down the real estate secured loan business as previously explained, the number and balance of reverse mortgage guarantees, the mainstay for the business, have firmly increased. We expect the impact of downsizing the real estate secured loan business to wind down in FY6/24 and results to stabilize from FY6/25 onward.

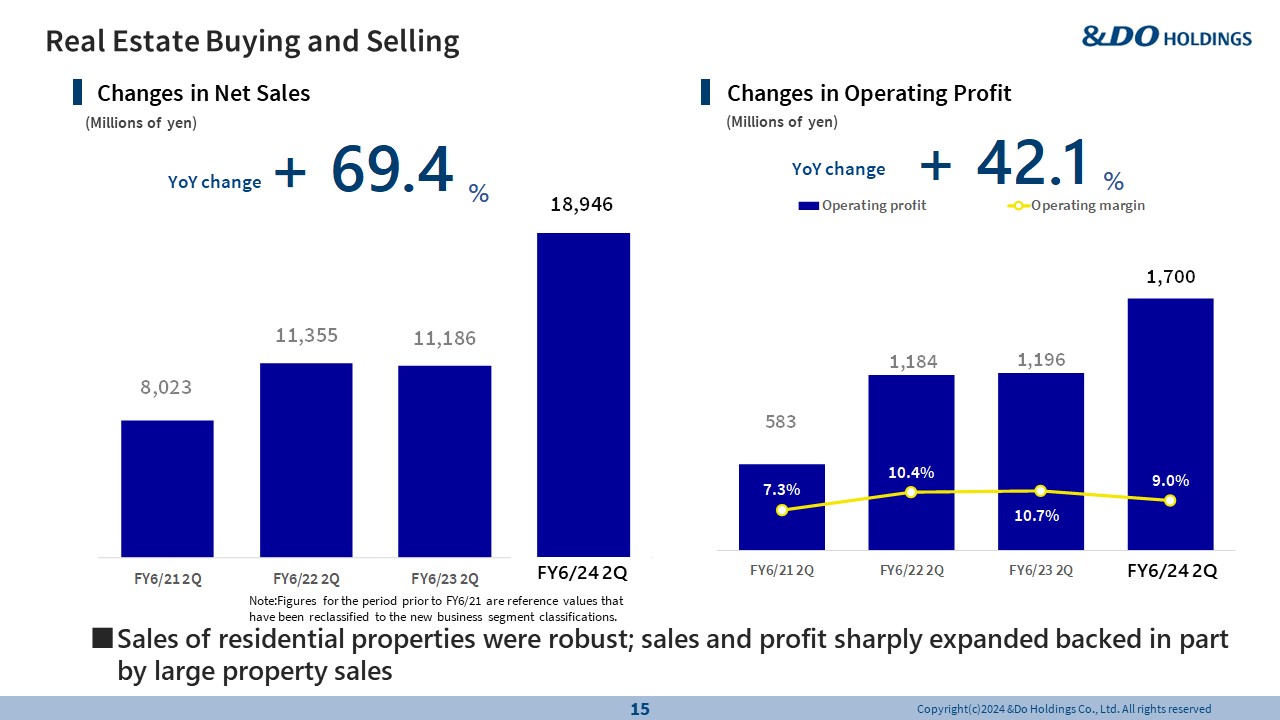

Looking at the Real Estate Buying and Selling Business, although the results here include sales of some large properties, performance was remarkably strong. The market continues to be bullish, and sales of residential properties have been brisk.

-

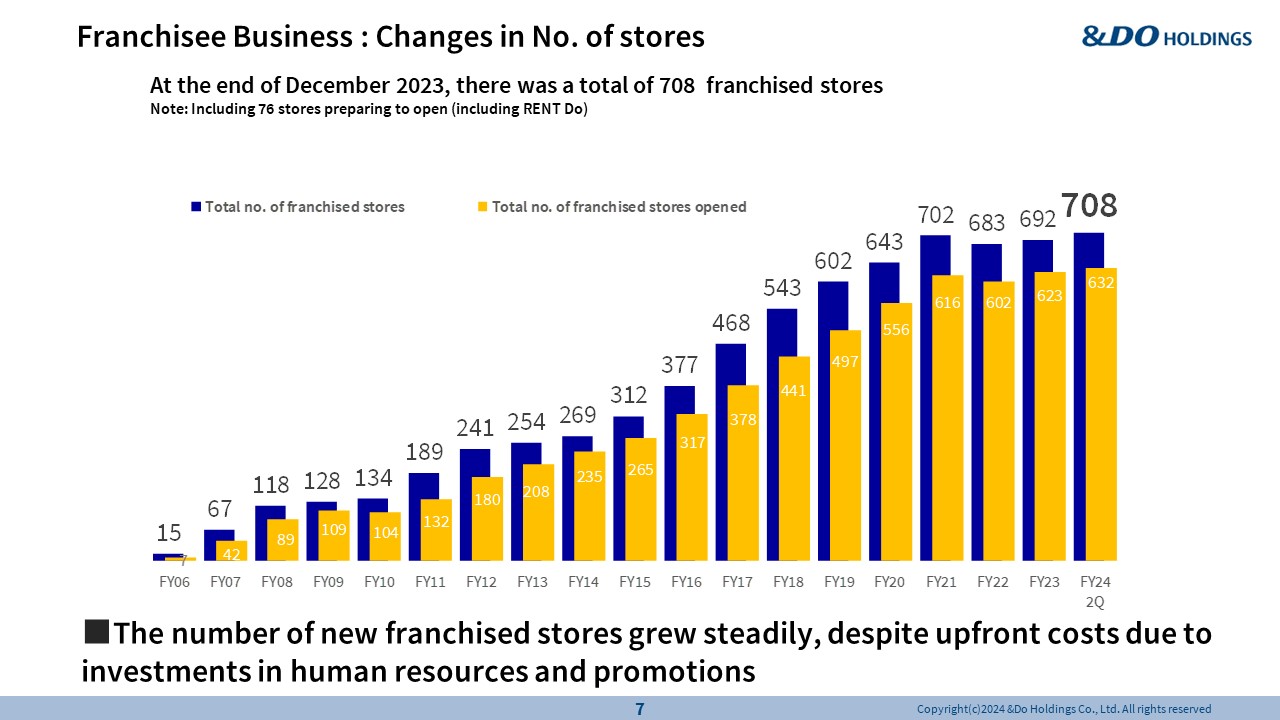

Franchisee Business : Changes in No. of stores

In the Franchisee Business, performance held firm, as franchisee withdrawals caused by the COVID-19 pandemic wound down and stabilized. Lately, among franchisees, there has been an increase in the number of real estate professionals in particular. The reason we launched the Franchisee Business in the first place was to bring on board real estate professionals as franchisees, and it seems that the HOUSE DO brand has finally become well known among them. We hoped this would happen sooner, but we are extremely hopeful that the recognition of the HOUSE DO brand will further increase now that real estate professionals are talking about it. We are very excited that the core trend of the business, which we can’t show in graphs, is finally becoming more evident. -

House-Leaseback Business

In the House-Leaseback Business, we have procured a solid number of House-Leaseback properties and have ample inventories. Initially, we aimed to secure 150 House-Leaseback properties a month, but decided to first firmly increase earnings in the Real Estate Buying and Selling Business and then work on expanding House-Leaseback properties. Tackling these two issues at once will not only put pressure on procurement but also strain sales, so we will first work to secure profit in the Real Estate Buying and Selling Business and shift our focus to real estate purchase and sales, as the House-Leaseback Business requires much upfront expenditures, which puts downward pressure on ordinary profit. That being said, if we can firmly grow earnings in the Real Estate Buying and Selling Business while securing 100 to 110 House-Leaseback properties a month, we will then accelerate our efforts to procure 150 House-Leaseback properties a month. We have ample inventories, so the business is performing strong. -

Finance Business (Reverse Mortgage Guarantees)

Reverse mortgage guarantees are an extremely attractive business, as we expect the balance of guarantees to continue growing steadily.

The balance of reverse mortgage guarantees may still be small, but we believe this figure will continue expanding. Right now, the balance stands at a little under 16over 16 billion yen, but we aim to bring this figure up to 100 billion yen as soon as possible, and further expand it to 200 billion, 300 billion, and 500 billion yen, and eventually to 1 trillion yen. We are often asked about the risk of this business, but we don’t see any risk. We can’t say that there is absolutely no risk, but we are gradually beginning to sell real estate properties (collateral for reverse mortgage) and view this as a business opportunity.

Regarding the sale of real estate, we can make sales anywhere in Japan by utilizing our nationwide network of real estate operations. What sets us apart from other guarantor companies is that we do not incur costs for real estate sales. Because we collaborate with our franchisees in selling real estate properties, cost of sales is almost zero. However, for other guarantor companies, unless real estate is their core business, they need to rely on real estate agents for sales. This inevitably results in costs amounting to 10?20% of the property value. Consequently, these guarantor companies can only provide guarantees for up to approximately 30% of the loan-to-value (LTV) ratio. In contrast, we can eliminate these costs, so as long as we sell properties with LTV ratios of roughly 50%, we won’t incur any losses. Further, because we can refine, build, and renovate properties, we can even generate profits.

-

Real Estate Buying and Selling Business

Results in the Real Estate Buying and Selling Business are solid. Sales and profit firmly increased, thanks in part to sales of some large properties. We will disclose the breakdown of results at the full-year results briefing, but we are beginning to see our efforts bearing fruit, as sales of the mainstay residential properties expanded, even excluding the sales of large properties. Because procurement precedes sales, borrowings and inventories tend to balloon up before sales are recorded, prompting some to question the soundness of our balance sheet. We first purchase properties, which we then sell in about 10 months to a year and record gains on sale as profit.

We have been hearing concerns over whether residential properties will sell against a backdrop of rising interest rates, but we’re not particularly worried because we target properties in prime locations and because we do not take on large development projects. We handle relatively small development projects, comprising five to six units at most, to avoid having to deal with unsold units, and purchase pre-owned homes with land, which we then scrap to build a new home. We make sure that these properties are located close to train stations or in convenient areas so that we can promptly sell them to reap returns. We think large development projects, which are usually located in areas outside urban centers, are risky. Considering that the population is declining, with depopulation also under way, properties will not sell unless they are in convenient, prime locations.

Depopulation is ongoing in areas that are even remotely inconvenient, and in regional areas as well, the population is concentrating in urban centers. This is only natural in that long ago, when the population was still growing, people spread out from the urban centers into the suburbs, but now that the population is shrinking, people are moving back into the urban areas. For this reason, properties in prime locations continue to enjoy a bullish market. Hence, as long as we focus on properties in prime locations, we will have no issue.

-

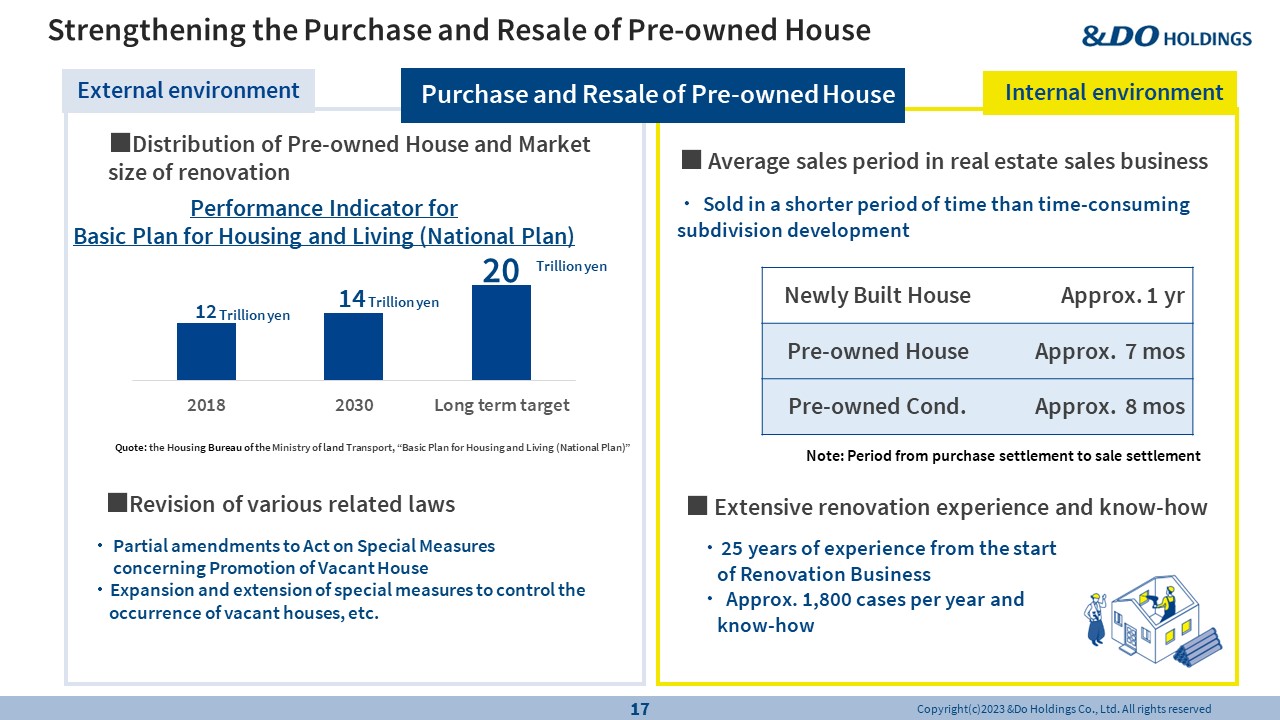

Strengthening the Purchase and Resale of Pre-owned House

As we explained in the previous results briefing, we are working to expand the pre-owned home resale business, and we have indicated progress in this front using turnover and days in inventory. Pre-owned homes are attractive in that we can recoup investments in about seven months. Some newly built homes take over a year to sell, but we do our best to sell them off in about a year. -

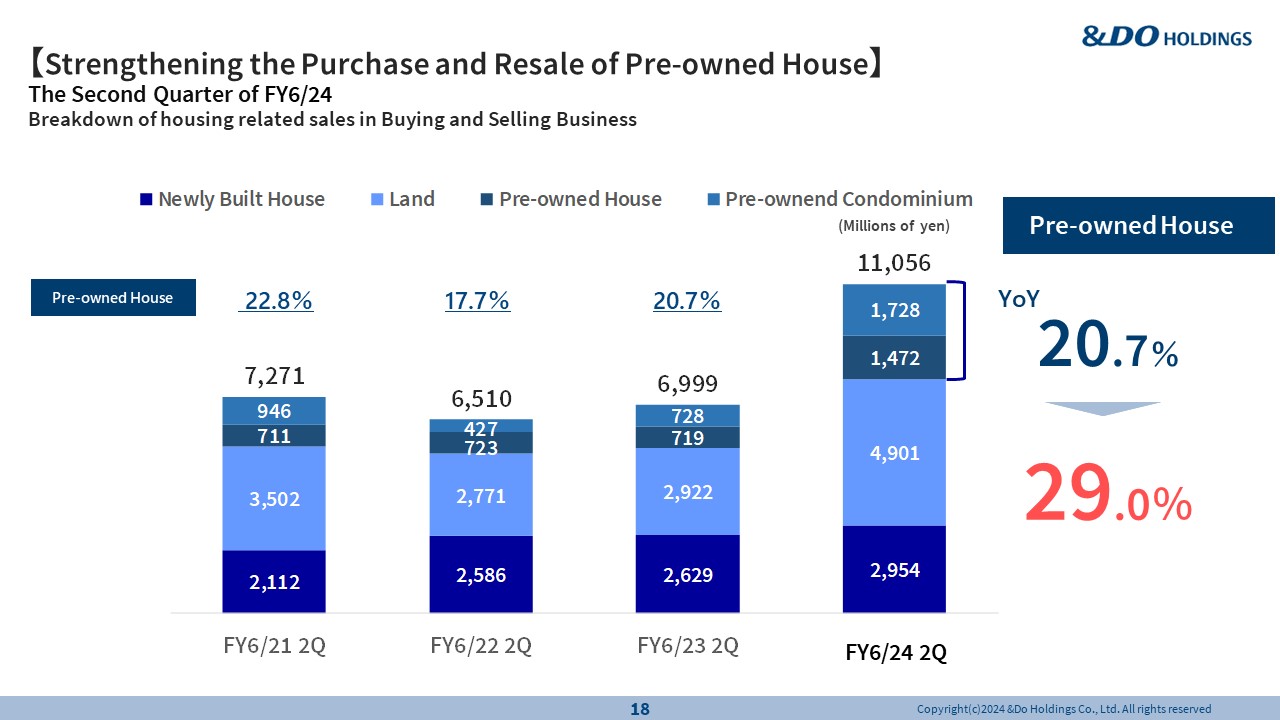

【Strengthening the Purchase and Resale of Pre-owned House】 The Second Quarter of FY6/24 Breakdown

Because the overall sales volume of properties, including both newly built and pre-owned homes, have increased, the sales weighting of pre-owned homes will hover around 20% for some time, even if the number of pre-owned homes sold increases. We expect the sales weighting of pre-owned homes to rise at some point in the future, but for now, rather than being overly focused on this ratio, we intend to concentrate on expanding the sales volume. Although the purchase and sale of pre-owned homes require more work, they are good business in that turnover is quick. We intend to develop this business while keeping an eye on the business environment.

-

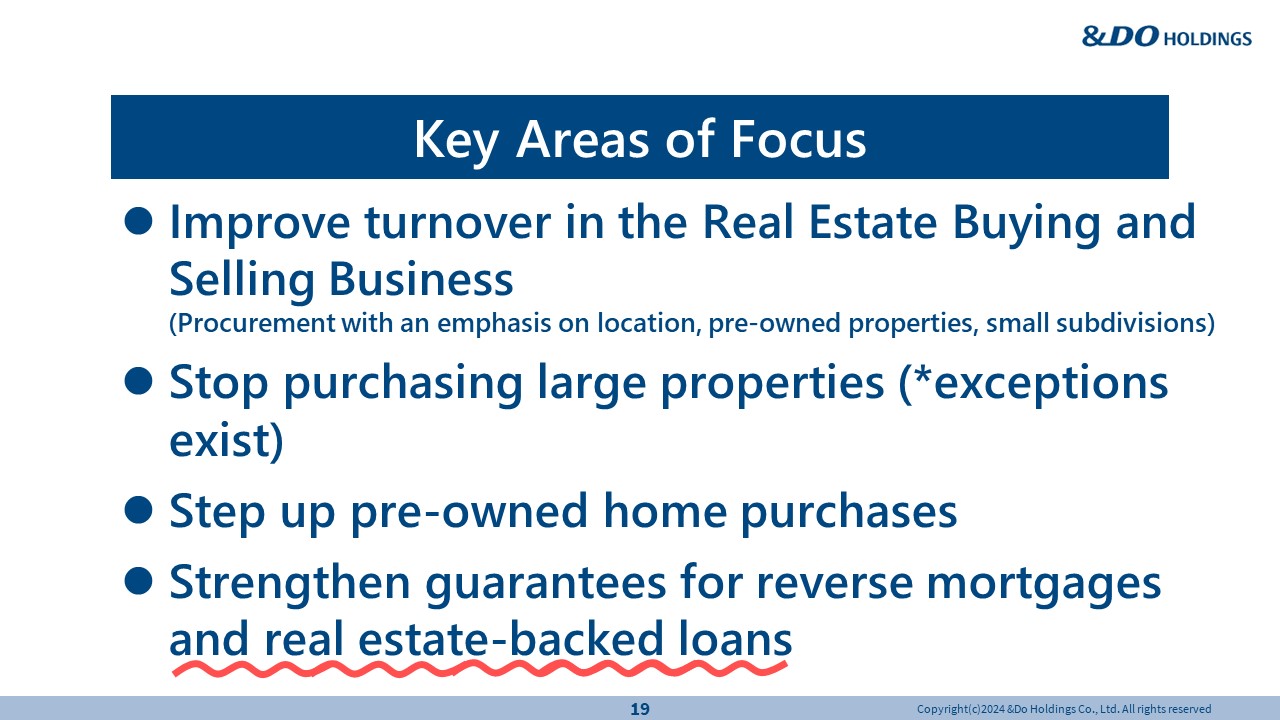

Key areas of focus

We have four key areas of focus going forward. First is improving the turnover ratio in the Real Estate Buying and Selling Business, i.e., quickly turning properties and recouping investments. We believe pre-owned homes are strong in that aspect, and for small development projects, we will focus on swiftly selling all units to reap returns. Until now, we have focused on growing the volume of properties offered and sold, including those with long turnover that could inflate inventories and were burdensome to manage, but from now on, we will focus instead on enhancing the quality of properties with shorter turnover. We have informed our sales staff of our such intention, and they were receptive to and highly motivated to take on this approach. Turnover is improving. We will refrain from purchasing large properties for the time being. There may be exceptions, but unless they are offered at an extremely attractive price, we won’t buy them. Real estate prices have increased substantially, and we are not going to go over and beyond to purchase these properties.

We will work to bolster the pre-owned home purchase and resale business and diligently work on the fourth priority, the reverse mortgage guarantee business. We also plan to allocate some of our resources to the real estate secured loan guarantee business. We won’t be taking an aggressive approach to grow this business, but we are thinking about offering real estate secured loan guarantees in combination with reverse mortgages to respond to some clients’ requests for extra financing, and meet their demand for higher LTV ratios. We are currently discussing this matter with financial institutions, and will make a public disclosure once it becomes official.

-

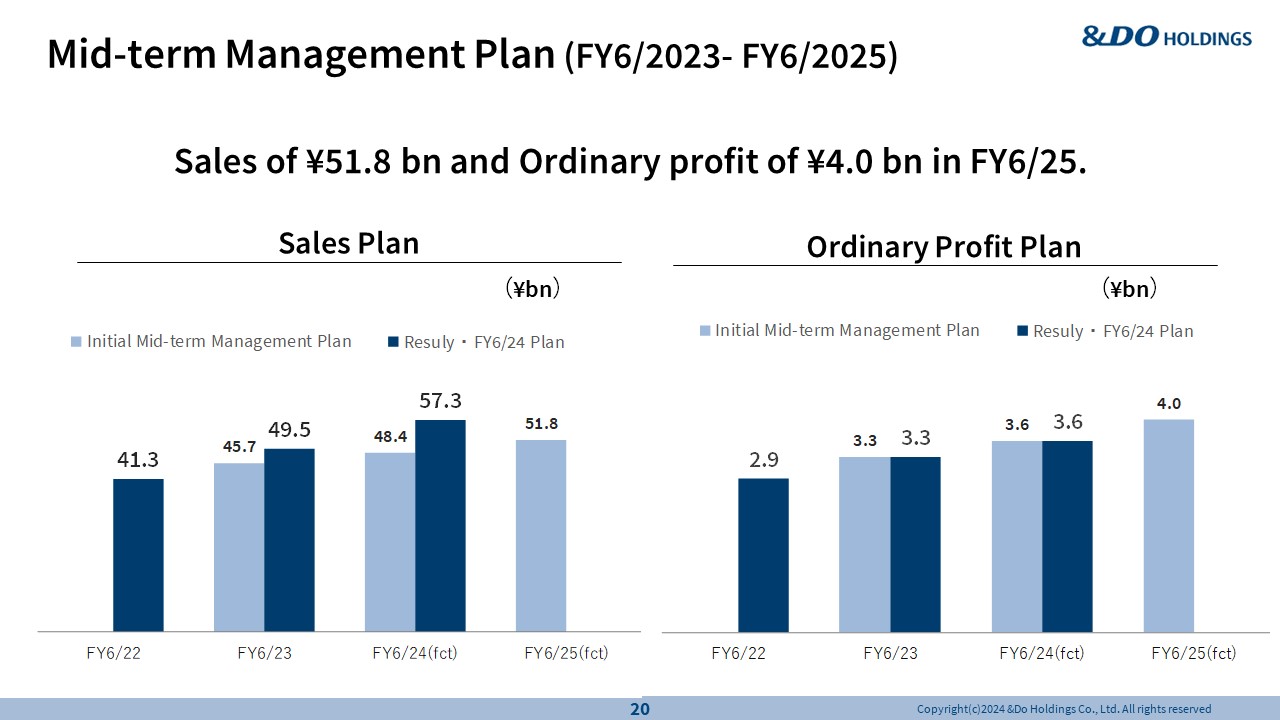

Mid-term Management Plan (FY6/2023- FY6/2025)

FY6/24 is the second year of the three-year medium-term management plan unveiled in FY6/23. We intend to achieve the ordinary profit target of 3.6 billion yen by the end of FY6/24 and further grow this indicator to 4.0 billion yen by the end of FY6/25. We plan to release an official forecast for the pre-owned home resale business at the end of FY6/24, and a new medium-term management plan after the end of FY6/25, which we believe will be more straightforward and easier-to-understand than the current plan. We are doing our best to build a solid business base, and going forward, we intend to follow a straightforward and clear growth trajectory. We kindly ask for your continued support and guidance. Thank you.